Crypto Spot Trading Vs Margin Trading: What is The Difference?

Leveraged buying and selling comes with elevated risk, as losses can exceed the preliminary investment as a outcome of leverage. It additionally entails paying curiosity on the borrowed funds and maintaining a minimal margin requirement. A spot commerce, also known as a spot transaction, refers back to the buy or sale of a foreign forex, monetary instrument, or commodity for fast delivery on a specified spot date.  The key distinction is that margin buying and selling makes use of leverage, while spot trading doesn’t. The dealer has purchased $1,000 worth of ETH using leverage of 5x (i.e., they borrowed $800 and used $200 of their very own funds). Assuming the margin required by the trade or trading platform is 15% of the account value, then there is a margin name as a result of the fairness degree has dropped under the margin requirement degree. Because the market value of an asset fluctuates in real-time, so does the fairness stage. When the equity stage drops beneath a certain threshold (also often recognized as the margin requirement, which is set by the change or trading platform), the trader will get a margin name.

The key distinction is that margin buying and selling makes use of leverage, while spot trading doesn’t. The dealer has purchased $1,000 worth of ETH using leverage of 5x (i.e., they borrowed $800 and used $200 of their very own funds). Assuming the margin required by the trade or trading platform is 15% of the account value, then there is a margin name as a result of the fairness degree has dropped under the margin requirement degree. Because the market value of an asset fluctuates in real-time, so does the fairness stage. When the equity stage drops beneath a certain threshold (also often recognized as the margin requirement, which is set by the change or trading platform), the trader will get a margin name. After all, as a mode of buying and selling, margin trading isn’t limited by the kind of asset involved. You shouldn’t construe any such info or other materials as legal, tax, funding, monetary, or other recommendation. Nothing contained herein shall represent a solicitation, recommendation, endorsement, or provide by Crypto.com to invest, buy, or promote any coins, tokens, or different crypto assets. Returns on the shopping for and promoting of crypto property may be topic to tax, together with capital features tax, in your jurisdiction. Any descriptions of Crypto.com products or options are merely for illustrative purposes and do not represent an endorsement, invitation, or solicitation. The dealer will have to give you $35 by either selling some ETH or putting in additional of their own money so as to convey the equity again as a lot as the margin requirement.

After all, as a mode of buying and selling, margin trading isn’t limited by the kind of asset involved. You shouldn’t construe any such info or other materials as legal, tax, funding, monetary, or other recommendation. Nothing contained herein shall represent a solicitation, recommendation, endorsement, or provide by Crypto.com to invest, buy, or promote any coins, tokens, or different crypto assets. Returns on the shopping for and promoting of crypto property may be topic to tax, together with capital features tax, in your jurisdiction. Any descriptions of Crypto.com products or options are merely for illustrative purposes and do not represent an endorsement, invitation, or solicitation. The dealer will have to give you $35 by either selling some ETH or putting in additional of their own money so as to convey the equity again as a lot as the margin requirement. Margin buying and selling does, however, probably magnify potential losses, so traders must be aware of the hazards. Margin buying and selling permits merchants to commerce a bigger stake than they might with their very own capital by borrowing cash from a cryptocurrency exchange. The key distinction in comparability with spot trading, subsequently, is that margin trading permits the dealer to open a position with out having to pay the full amount from their own pocket. The key ideas to know in margin trading are leverage, margin, collateral, and liquidation. Crypto margin trading may be profitable for skilled traders who understand the dangers concerned and have a strong buying and selling technique. However, crypto margin buying and selling additionally carries a excessive degree of threat as a end result of leverage, and inexperienced merchants could incur significant losses.

Margin buying and selling does, however, probably magnify potential losses, so traders must be aware of the hazards. Margin buying and selling permits merchants to commerce a bigger stake than they might with their very own capital by borrowing cash from a cryptocurrency exchange. The key distinction in comparability with spot trading, subsequently, is that margin trading permits the dealer to open a position with out having to pay the full amount from their own pocket. The key ideas to know in margin trading are leverage, margin, collateral, and liquidation. Crypto margin trading may be profitable for skilled traders who understand the dangers concerned and have a strong buying and selling technique. However, crypto margin buying and selling additionally carries a excessive degree of threat as a end result of leverage, and inexperienced merchants could incur significant losses. A trader who buys a cryptocurrency in a spot transaction owns the underlying asset and is free to maintain it for nonetheless long they choose. Since spot trading includes buying and selling belongings immediately, it is a simple method of buying and selling cryptocurrencies. Spot buying and selling is considered less risky in comparison with margin trading, as the dealer just isn’t uncovered to the potential losses from leverage.

A trader who buys a cryptocurrency in a spot transaction owns the underlying asset and is free to maintain it for nonetheless long they choose. Since spot trading includes buying and selling belongings immediately, it is a simple method of buying and selling cryptocurrencies. Spot buying and selling is considered less risky in comparison with margin trading, as the dealer just isn’t uncovered to the potential losses from leverage.

The key distinction is that margin buying and selling makes use of leverage, while spot trading doesn’t. The dealer has purchased $1,000 worth of ETH using leverage of 5x (i.e., they borrowed $800 and used $200 of their very own funds). Assuming the margin required by the trade or trading platform is 15% of the account value, then there is a margin name as a result of the fairness degree has dropped under the margin requirement degree. Because the market value of an asset fluctuates in real-time, so does the fairness stage. When the equity stage drops beneath a certain threshold (also often recognized as the margin requirement, which is set by the change or trading platform), the trader will get a margin name.

The key distinction is that margin buying and selling makes use of leverage, while spot trading doesn’t. The dealer has purchased $1,000 worth of ETH using leverage of 5x (i.e., they borrowed $800 and used $200 of their very own funds). Assuming the margin required by the trade or trading platform is 15% of the account value, then there is a margin name as a result of the fairness degree has dropped under the margin requirement degree. Because the market value of an asset fluctuates in real-time, so does the fairness stage. When the equity stage drops beneath a certain threshold (also often recognized as the margin requirement, which is set by the change or trading platform), the trader will get a margin name.How Does Margin Trading Work?

Margin traders are referred to as makers, since margin traders are trading with futures contracts, meaning that they are betting on costs either rising or decreasing. What this implies is that a dealer might open a long place and if the worth increases, he makes income, if he opens short positions, a drop in worth is what is going to generate profits. Because of this, these merchants are creating liquidity as they are creating orders that shall be available sooner or later and lots of spot merchants are literally buying and selling with these margin orders. Because of this, margin merchants usually pay lesser buying and selling fees, however in addition they need to pay margin fees. If they fail to satisfy the margin call, then the trade or buying and selling platform can forcibly sell the ETH in the account to help pay down the loan. Given the immediate nature of spot buying and selling, a dealer must have the total amount of funds to pay for the commerce. The largest cryptocurrency change by trading volume is Binance, and it’s in the primary spot for a reason. Since its launch in 2018, Binance has been introducing all conceivable buying and selling features, margin buying and selling included. But as we talked about before, it is best to make use of each buying and selling kinds, and don’t restrict yourself to only considered one of these two. When you see an excellent opportunity for a spot trade, you must take it, and when you see an excellent margin option, the potential income are something you can’t ignore as properly. Hedging is widely used in all markets, not simply crypto, to guard against big losses. Given the volatility, it’s much more essential in crypto markets than in stocks. With a short position, you comply with promote a specific amount of crypto — for instance, one Bitcoin — at a sure date however haven’t purchased it but. The aim is to find a way to purchase it cheaper than the quantity the counterparty buyer has agreed to pay for it.

What’s Margin Trading?

The amount of leverage that can be used varies throughout completely different exchanges and buying and selling platforms. Crypto spot trading is taken into account one of the least dangerous buying and selling kinds that a person can select. Since throughout spot trading you are buying and selling on the current market worth, you’ll have the ability to decide whenever you need to trade and aren’t limited to stuff similar spot trading vs margin trading to margin calls, futures fees, and so forth. You should buy crypto on the spot market and if the price falls, you can simply wait for the value to go up once more and sell only after this happens. People who commerce with cryptocurrencies are known as takers since they’re taking from the liquidity pool as their orders are being executed immediately. When a purchase or promote order is placed on the spot market, the system automatically looks on the order book and tries to match two events collectively. After all, as a mode of buying and selling, margin trading isn’t limited by the kind of asset involved. You shouldn’t construe any such info or other materials as legal, tax, funding, monetary, or other recommendation. Nothing contained herein shall represent a solicitation, recommendation, endorsement, or provide by Crypto.com to invest, buy, or promote any coins, tokens, or different crypto assets. Returns on the shopping for and promoting of crypto property may be topic to tax, together with capital features tax, in your jurisdiction. Any descriptions of Crypto.com products or options are merely for illustrative purposes and do not represent an endorsement, invitation, or solicitation. The dealer will have to give you $35 by either selling some ETH or putting in additional of their own money so as to convey the equity again as a lot as the margin requirement.

After all, as a mode of buying and selling, margin trading isn’t limited by the kind of asset involved. You shouldn’t construe any such info or other materials as legal, tax, funding, monetary, or other recommendation. Nothing contained herein shall represent a solicitation, recommendation, endorsement, or provide by Crypto.com to invest, buy, or promote any coins, tokens, or different crypto assets. Returns on the shopping for and promoting of crypto property may be topic to tax, together with capital features tax, in your jurisdiction. Any descriptions of Crypto.com products or options are merely for illustrative purposes and do not represent an endorsement, invitation, or solicitation. The dealer will have to give you $35 by either selling some ETH or putting in additional of their own money so as to convey the equity again as a lot as the margin requirement.Spot Buying And Selling Vs Margin Trading Pros And Cons

It is essential to conduct thorough analysis and apply risk administration when partaking in crypto margin buying and selling. Some cryptocurrency exchanges provide a substitute for leveraged buying and selling that lets traders use the leverage without the risk of liquidation. These are leveraged tokens, backed by a contract that tracks a protracted or brief place within the specified asset. Margin buying and selling on the Crypto.com Exchange permits customers to borrow virtual assets on Crypto.com Exchange to trade on the spot market. Eligible customers can utilise the margin loan as leverage (borrowed digital assets) to open a position that’s larger than the balance of their account.- Returns on the shopping for and selling of crypto belongings could additionally be subject to tax, together with capital positive aspects tax, in your jurisdiction.

- No one can say definitively that one is best than the opposite since these two are very common and in style methods to trade.

- Margin buying and selling can amplify both gains and losses, so it carries a better level of risk in comparability with traditional buying and selling.

- Most commodity buying and selling is for future settlement and is not delivered; the contract is offered back to the change prior to maturity, and the acquire or loss is settled in cash.

- The key distinction compared to spot trading, due to this fact, is that margin buying and selling allows the dealer to open a place without having to pay the full quantity from their very own pocket.

What’s 10x Leverage In Crypto?

Cryptocurrency trading has turn out to be a very good various for people who discover themselves thinking about trading however are looking for more volatile property to find a way to enhance their income. In the start, the one locations people might commerce with cryptocurrencies have been dedicated crypto exchanges, however these days common brokers began to offer crypto CFD buying and selling to customers. Risk and reward often go hand in hand, so for many who are keen and in a position to take on more threat for the possibility of potentially larger gains, then margin trading might be an option. For more standard traders, spot buying and selling could be much less risky and easier to execute. Margin buying and selling does, however, probably magnify potential losses, so traders must be aware of the hazards. Margin buying and selling permits merchants to commerce a bigger stake than they might with their very own capital by borrowing cash from a cryptocurrency exchange. The key distinction in comparability with spot trading, subsequently, is that margin trading permits the dealer to open a position with out having to pay the full amount from their own pocket. The key ideas to know in margin trading are leverage, margin, collateral, and liquidation. Crypto margin trading may be profitable for skilled traders who understand the dangers concerned and have a strong buying and selling technique. However, crypto margin buying and selling additionally carries a excessive degree of threat as a end result of leverage, and inexperienced merchants could incur significant losses.

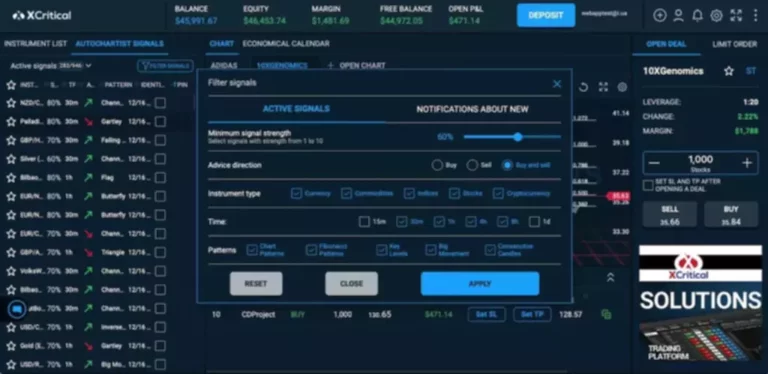

Margin buying and selling does, however, probably magnify potential losses, so traders must be aware of the hazards. Margin buying and selling permits merchants to commerce a bigger stake than they might with their very own capital by borrowing cash from a cryptocurrency exchange. The key distinction in comparability with spot trading, subsequently, is that margin trading permits the dealer to open a position with out having to pay the full amount from their own pocket. The key ideas to know in margin trading are leverage, margin, collateral, and liquidation. Crypto margin trading may be profitable for skilled traders who understand the dangers concerned and have a strong buying and selling technique. However, crypto margin buying and selling additionally carries a excessive degree of threat as a end result of leverage, and inexperienced merchants could incur significant losses.Prime Crypto Margin Trading Platforms

The primary disadvantage of spot buying and selling is that it misses out on any potential amplification of returns that using leverage can convey, which we focus on beneath. Prepare to do the math to know how a lot of your income will turn into revenue after accounting for all the Kraken fees. They are about as a lot as 0.02% for opening a place and rollover every four hours, plus the normal buying and selling fee. What about extra complex modes of trading, like ones that contain derivatives and contracts, such as futures? That’s when the trade automatically closes the position and sells your collateral to pay off the lenders, who want their principal again and the curiosity you owe them. The value of crypto assets can improve or lower, and you would lose all or a considerable quantity of your purchase worth. When coping with cryptocurrencies, do not forget that they are extremely volatile and thus, a high-risk funding. Consider investing in cryptocurrencies solely after cautious consideration and evaluation of your own analysis and at your individual risk. Curiously enough, derivatives buying and selling and leveraged trading aren’t mutually unique but as a result of compounding dangers, it isn’t a typical combination. When assessing a crypto asset, it’s important so that you can do your analysis and due diligence to make the very best judgement, as any purchases shall be your sole duty. Spot markets exist not only in crypto however in different asset classes as well, similar to shares, forex, commodities, and bonds. Learn extra about what spot and margin buying and selling are, their pros and cons, and how you might choose between the two. The worth for any instrument that settles later than the spot is a combination of the spot worth and the curiosity value till the settlement date. In the case of foreign exchange, the interest rate differential between the two currencies is used for this calculation. We have already touched upon the method behind margin trading but let’s see how it works with a extra concrete instance. A trader who buys a cryptocurrency in a spot transaction owns the underlying asset and is free to maintain it for nonetheless long they choose. Since spot trading includes buying and selling belongings immediately, it is a simple method of buying and selling cryptocurrencies. Spot buying and selling is considered less risky in comparison with margin trading, as the dealer just isn’t uncovered to the potential losses from leverage.

A trader who buys a cryptocurrency in a spot transaction owns the underlying asset and is free to maintain it for nonetheless long they choose. Since spot trading includes buying and selling belongings immediately, it is a simple method of buying and selling cryptocurrencies. Spot buying and selling is considered less risky in comparison with margin trading, as the dealer just isn’t uncovered to the potential losses from leverage.